May 2024 Investment & Economic Update

Our latest monthly investment update for May 2024 examines how the global investment markets, economy, and commodities are performing.

Check out below all the articles and updates from Kellands.

Our latest monthly investment update for May 2024 examines how the global investment markets, economy, and commodities are performing.

Five options to consider to help boost your potential retirement income.

We look at the changes to the tax rules at the start of the new tax year and how to make sure your savings and investments are as tax efficient as possible by using all your available allowances and exemptions.

Our latest monthly investment update for April 2024 examines how the global investment markets, economy, and commodities are performing.

Chancellor Jeremy Hunt unveils a Spring Budget with major tax cuts and economic reforms ahead of the upcoming general election.

Our latest monthly investment update for March 2024 examines how the global investment markets, economy, and commodities are performing.

Individuals now need significantly more for a comfortable retirement due to rising living costs and family support expectations.

Kellands are committed supporters of Children in Need and every year we look to raise money for this worthy cause.

Our latest monthly investment update for February 2024 examines how the global investment markets, economy, and commodities are performing.

British savers hold £380.9 billion in low-interest accounts, missing out on higher returns.

Our latest monthly investment update for January 2024 examines how the global investment markets, economy, and commodities are performing.

Cash or other financial gifts might be more welcome than ever this Christmas. Here’s some things you need to know.

Our latest monthly investment update for December 2023 examines how the global investment markets, economy, and commodities are performing.

Our latest monthly investment update for November 2023 examines how the global investment markets, economy, and commodities are performing.

Starting estate planning early and implementing it in stages is desirable.

Our latest monthly investment update for October 2023 examines how the global investment markets, economy, and commodities are performing.

Our latest monthly investment update for September 2023 examines how the global investment markets, economy, and commodities are performing.

New research highlights many have a lack of confidence in their retirement prospects.

Our latest monthly investment update for August 2023 examines how the global investment markets, economy, and commodities are performing.

A few ideas to help you increase your chances of a comfortable retirement.

Our latest monthly investment update for July 2023 examines how the global investment markets, economy, and commodities are performing.

Recent research study highlights a significant gap in the money skills of many youngsters.

Our latest monthly investment update for June 2023 examines how the global investment markets, economy, and commodities are performing.

Why the golden rule of investing is even more pertinent in times of uncertainty and volatility.

What to take into account before deciding whether to put money into a pension or an ISA.

Our latest monthly investment update for May 2023 examines how the global investment markets, economy, and commodities are performing.

Asset allocation is a fundamental concept in investment management that helps investors manage their risk while maximising their returns.

Ready to retire, but worried about your savings running out? Read on for a few tips.

Pension pots have always had a role to play in inheritance tax planning but the scrapping of the pensions lifetime allowance means you could now potentially leave large sums completely free of inheritance tax.

Rising inflation and costs mean the amount of money you need to enjoy later life has risen significantly.

In his first Budget as Chancellor, Jeremy Hunt has announced several measures to re-engage those who have left the workforce and encourage business investment.

Our latest monthly investment update for March 2023 looks at how the global investment markets, economy, and commodities are performing.

With the end of the tax year fast approaching, there may still be time to review your tax and financial affairs to make sure you have optimised all your tax allowances and tax planning opportunities. So here’s a few of things to look at before the start of the new tax year on 6 April 2023.

Our latest monthly investment update for February 2023 looks at how the global investment markets, economy, and commodities are performing.

New research has highlighted the value of financial advice for couples.

Our latest monthly investment update for January 2023 looks at how the global investment markets, economy, and commodities are performing.

Our latest monthly investment update for December 2022 looks at how the global investment markets, economy, and commodities are performing.

Our latest monthly investment update for November 2022 looks at how the global investment markets, economy, and commodities are performing.

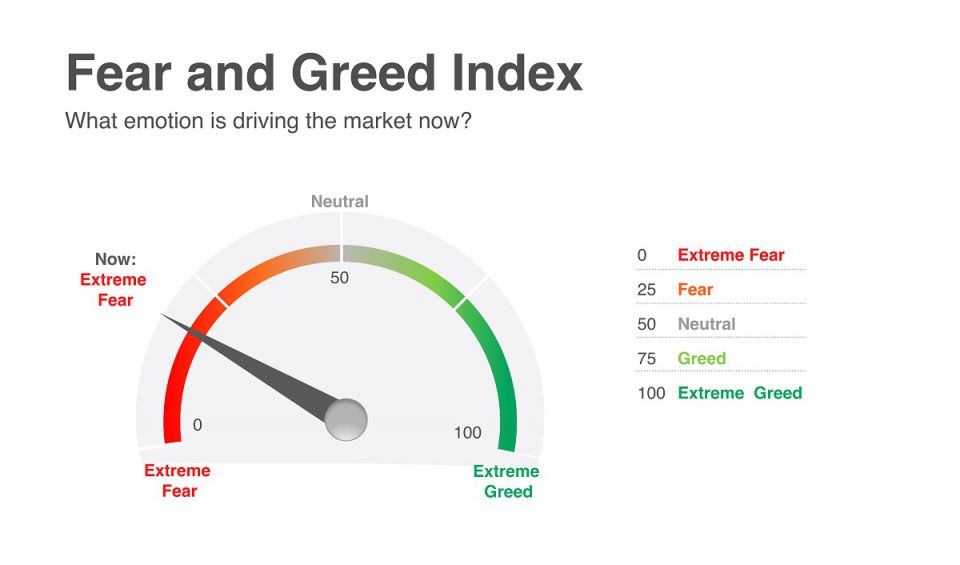

A look at market sentiment in the current environment.

It’s been a worrying few weeks in the global financial markets. Read below about the current uncertainty, and why it’s important to remain calm in volatile times.

Our latest monthly investment update for October 2022 looks at how the global investment markets, economy, and commodities are performing.

In commemoration of Queen Elizabeth, Queen of the United Kingdom and other Commonwealth realms

Our latest monthly investment update for September 2022 looks at how the global investment markets, economy, and commodities are performing.

Our latest monthly investment update for August 2022 looks at how the global investment markets, economy, and commodities are performing.

Despite rising inflation and the cost-of-living crisis, why you should think twice before dipping into your pension to help out your finances.

Our latest monthly investment update for July 2022 looks at how the global investment markets, economy, and commodities are performing.

Why investors and those planning for retirement need to keep calm and take a long-term view.

Our latest monthly investment update for June 2022 looks at how the global investment markets, economy, and commodities are performing.

With an ageing population, an increasing retirement age and less certainty in what to expect from your pensions, it could be a good time to review what you want from your later life.

Our latest monthly investment update for May 2022 looks at how the global investment markets, economy, and commodities are performing.

Only a quarter of pension savers using a workplace pension believe their current retirement saving rate will not be sufficient for later life.

Our latest monthly investment update for April 2022 looks at how the global investment markets, economy, and commodities are performing.

As another extraordinary financial year comes to a close, it’s more important than ever to make good use of your annual pension allowances. Giving your pension savings a boost and assessing where you stand will give you peace of mind that you are on track to enjoying the retirement you are planning for.

Our latest monthly investment update for March 2022 looks at how the global investment markets, economy, and commodities are performing.

The Russian invasion of Ukraine last week has sparked more uncertainty and volatility in the financial markets

Our latest monthly investment update for February 2022 looks at how the global investment markets, economy, and commodities are performing.

The pandemic saw more people start investing whilst others invested more through the enforced savings brought about by lockdown.

Our latest monthly investment update for January 2022 looks at how the global investment markets, economy, and commodities are performing.

Our latest monthly investment update for December 2021 looks at how the global investment markets, economy, and commodities are performing.

According to new research, more than half of UK adults say the Covid-19 pandemic has affected their retirement plans.

Our latest monthly investment update for November 2021 looks at how the global investment markets, economy, and commodities are performing.

The latest study from the Pensions and Lifetime Savings Association (PLSA) provides a guide to what income you may need

Many bereaved families are missing out on significant inheritance tax rebates

Our latest monthly investment update for October 2021 looks at how the global investment markets, economy, and commodities are performing.

A look at how to make the most of your pension pots and other investments to generate a decent retirement income.

Our latest monthly investment update for September 2021 looks at how the global investment markets, economy, and commodities are performing.

Latest statistics show a 4% increase in tax take with almost a third more families affected

Our latest monthly investment update for August 2021 looks at how the global investment markets, economy, and commodities are performing.

Price inflation in the UK is still rising, with the official rate up to 2.5% in the past year.

Our latest monthly investment update for July 2021 looks at how the global investment markets, economy, and commodities are performing.

An alternative way of looking at your financial affairs, providing you with food for thought.

A spate of recent surveys shows both how people have responded to pensions throughout the pandemic and their general lack of understanding and engagement.

Our latest monthly investment update for June 2021 looks at how the global investment markets, economy, and commodities are performing.

Whilst investors are increasingly prioritising socially responsible investments, fund managers are getting in on the act too.

Our latest monthly investment update for May 2021 looks at how the global investment markets, economy, and commodities are performing.

The pension lifetime allowance (LTA) has been around for 15 years, but the possibility of a potential 55% tax charge on ‘excess’ pension savings still causes confusion and anxiety for many.

Today is the start of the new tax year, so this could be the best time to take advantage of one of the tax breaks available to you, by opening a Stocks and Shares ISA.

In our latest monthly investment update for April 2021, we look at how the global investment markets, economy, and commodities are performing.

Aaron Pitt, Chartered Financial Planner at Kellands, takes a look at this perennial issue.

Matt Hodges, one of our Chartered Financial Planners, explains why there’s more to financial planning than just the financials.

Today is International Women’s Day, a day which celebrates the social, economic, cultural and political achievements of women from around the world. It is also an opportunity to look into the gender investing gap and what can be done to help encourage women to invest more and take control of their finances.

Here’s a quick summary of just some of the salient points for savers and investors as the Chancellor attempted to perform a balancing act.

In our latest monthly investment update for March 2021, we take a look at how the global investment markets, economy and commodities are performing.

A new set of pension legislation has received Royal Assent to become an Act of Parliament.

In our latest monthly investment update for February 2021, we take a look at how the global investment markets, economy and commodities are performing.

After the unprecedented events of 2020, it is quite likely that your perfectly diversified portfolio of a year ago may now need rebalancing.

Could this have been one of the sharpest but also one of the shortest bear markets on record?

In our latest monthly investment update for January 2021, we take a look at how the global investment markets, economy and commodities are performing.

In our latest monthly investment update for December 2020, we take a look at how the global investment markets, economy and commodities are performing.

The latest official figures offer some reasons to be cheerful about the state of recovery in the UK economy.

In our latest monthly investment update for October 2020, we take a look at how the global investment markets, economy and commodities are performing.

The government has announced that the minimum pension age will rise from 55 to 57 by 2028 to coincide with the rise in the state pension age to 67.

Has the Covid-19 pandemic and its associated economic fallout changed your attitudes towards investing?

In our latest monthly investment update for September 2020, we take a look at how the global investment markets, economy and commodities are performing.

In our latest monthly investment update for August 2020, we take a look at how the global investment markets, economy and commodities are performing.

Behavioural biases play a significant role in our decision-making as investors.

A scourge of the retail financial services profession are promotions for unregulated investments.

In our latest monthly investment update for July 2020, we take a look at how the global investment markets, economy and commodities are performing.

In our latest monthly investment update for June 2020, we take a look at how the global investment markets, economy and commodities are performing.

A surge in 55th birthdays and the fifth anniversary of pension freedoms were unintentionally timed this year to coincide with the current coronavirus pandemic.

In our latest monthly investment update for May 2020, we take a look at how the global investment markets, economy and commodities are performing.

During these challenging financial times, to what extent have pension savers been raiding pension pots?

The economic impact of the coronavirus pandemic on the UK is likely to be significant, but recovery may be quicker than in other countries.

In our latest monthly investment update for April 2020, we take a look at how the global investment markets, economy and commodities are performing.

In our latest monthly investment update for March 2020, we take a look at how the global investment markets, economy and commodities are performing.

As an investor, how should you be responding to the impact that the coronavirus is having on global stock markets?

With an ageing population and a prolonged period of rising property prices, it’s no surprise to see equity release growing in popularity.

In our latest investment update for February 2020, we take a look at how the global investment markets, economy and commodities are performing.

It’s no secret that the nature of retirement is changing. What used to be considered by many as a quiet, relaxing time in life, is increasingly becoming a period of greater activity.

As we start the New Year, we take a look at how the global investment markets, economy and commodities are performing.

In our latest monthly investment update for December 2019, we take a look at how the global investment markets, economy and commodities are performing.

If you reach retirement age with insufficient savings, you face several choices.

In our latest monthly investment update for November 2019, we take a look at how the global investment markets, economy and commodities are performing.

What’s your retirement savings target?

If you are in your 50s or 60s, your thoughts are probably turning towards retirement. When should you retire? How much money do you need?

The past decade has seen a big increase in ethical investing, although in overall terms, it is still a relatively niche market. In the middle of Good Money Week, which aims to let investors know about the range of ethical and sustainable financial options, we take a brief look at some of the statistics and issues.

When do you plan to retire? The date you select for your retirement can have a significant impact on the value of your pension pot.

As we reach the end of summer thoughts naturally turn to the future. Following the political turmoil being experienced through Brexit, it may seem a relatively challenging time for investors. Kelland’s Chartered Financial Planner, Chris Bull gives us an overview on the markets and whether times are as unique as they seem.

In our latest monthly investment update for September 2019, we take a look at how the global investment markets, economy and commodities are performing.

An unusual new bank has taken one of the top spots in a list of the biggest lenders.

Since the pension freedoms were introduced back in 2015, many retirement investors have opted for income drawdown as part of their retirement income strategy. This can make sense for many, but there are risks involved.

The increasing popularity of equity release as part of the retirement planning mix was demonstrated in 2017, which saw new records set in the equity release market.

15/5/2024

Royal Mail's owner IDS said it had received a revised proposal of 370p a share from a Czech billionaire.

May 3, 2024

Our latest monthly investment update for May 2024 examines how the global investment markets, economy, and commodities are performing.

Read more